Securing wealth in today’s rapidly evolving financial landscape cannot be overstated. As we look into 2024 and beyond, luxury property investments stand out as a premier strategy for wealth preservation and growth. This blog explores why these investments are attractive and essential for individuals looking to safeguard and enhance their financial standing.

Understanding Luxury Property Investments

Before discussing current market trends and strategic benefits, let’s clarify what luxury property investments entail. These typically involve high-end residential or commercial properties in sought-after locations, often characterized by premium amenities, design, and exclusivity. Luxury properties can include everything from upscale condominiums and villas to expansive estates and premium office spaces.

As we navigate the investment landscape, it’s vital to consider the allure of luxury and the data and trends that underpin these opportunities. Understanding these elements with market fluctuations and economic uncertainties will empower investors to make informed decisions.

Traditional vs. Luxury Real Estate Investments

The distinction between traditional and luxury real estate investments is crucial for understanding the market dynamics. Regular real estate appeals to a broad demographic, while luxury real estate attracts HNWIs seeking unique and aspirational properties. The financial stability of HNWIs offers a buffer against economic fluctuations that can impact the general property market.

Moreover, luxury real estate has the potential to revitalize urban areas, creating high-end developments that enhance local retail and cultural experiences. While traditional properties provide affordable housing and social diversity, luxury investments contribute to cities’ overall character and economic stability.

Types of Luxury Property Investments

Investors in luxury real estate have various options, each offering unique opportunities and risks. Here are some prominent types of luxury property investments:

Residential Luxury Properties include a broad spectrum of homes, from grand chateaux to modern penthouses. Buyers’ definitions of luxury vary, with factors such as views, size, and iconic locations playing significant roles in valuation. Properties in prime locations, such as Manhattan or Monaco, retain long-term appeal and often appreciate significantly over time.

Luxury Commercial Properties: High-end retail spaces and boutique hotels present lucrative investment opportunities. Successful investments in this category often rely on thorough market research to ensure potential tenants and customers can afford premium offerings.

Luxury Property Funds: For investors seeking a lower entry point into the luxury market, property funds offer an accessible alternative. Real estate investment trusts (REITs) and mutual funds focusing on luxury properties allow investors to enjoy the benefits of luxury investments without direct ownership challenges.

Luxury Real Estate: Analyzing Current Market Trends

The luxury real estate market has shown remarkable resilience despite broader economic challenges. According to a recent report by Knight Frank, the number of ultra-high-net-worth individuals (UHNWIs) has increased globally, with an estimated 2.6 million individuals now classified as such. This growing demographic fuels demand for luxury properties, especially in major urban centers and scenic locales.

Key trends shaping the luxury property landscape include:

- Sustainability and Eco-Friendly Features: Today’s luxury buyers prioritize sustainability. Properties with green certifications, energy-efficient technologies, and eco-friendly materials are not only more desirable but often command higher prices.

- Technological Integration: Smart home technologies are becoming standard in luxury properties. Buyers seek homes with advanced security systems, automated climate controls, and high-tech entertainment options.

- Shift in Buyer Preferences: Post-pandemic, there’s a noticeable shift in preferences towards properties that offer more space and outdoor amenities. Homes with expansive gardens, terraces, or proximity to nature are increasingly sought after.

- Geographical Shifts: While traditional luxury markets like New York and London remain strong, emerging markets in Asia and the Middle East are gaining traction. Cities such as Singapore and Dubai attract significant investment due to their robust economic growth and lifestyle offerings.

These trends highlight the evolving nature of luxury real estate and underscore its potential as a lucrative investment avenue.

Strategic Benefits of Investing in Luxury Real Estate

Investing in luxury property has a plethora of strategic benefits. Here are some compelling reasons why investors are gravitating toward this asset class.

1. Long-Term Appreciation: Historically, luxury properties have appreciated faster than standard real estate. According to a study by Wealth-X, luxury real estate values increased by 8% on average over the last decade, outpacing general market growth. This trend suggests that luxury investments retain value and have the potential for substantial capital gains.

2. Portfolio Diversification: Luxury properties offer a unique opportunity for portfolio diversification. They often behave differently from traditional investments like stocks and bonds. When other markets are volatile, luxury real estate can provide a stabilizing effect, making it an essential component of a well-rounded investment strategy.

3. Rental Income Potential: Luxury properties can generate significant rental income, especially in high-demand markets. Short-term rental platforms have transformed how luxury properties are leased, providing owners with flexibility and lucrative opportunities. High-net-worth individuals are often willing to pay premium prices for unique and well-located properties, ensuring steady cash flow for investors.

4. Tax Advantages: Depending on your location, investing in real estate can offer various tax benefits. Property owners can deduct mortgage interest, property taxes, and certain expenses in many jurisdictions, reducing their overall tax burden.

5. Status and Lifestyle: Beyond financial returns, luxury property investments can enhance one’s lifestyle. Owning a high-end property often comes with exclusive access to amenities and experiences, making it a desirable investment for many affluent individuals.

Managing Risks in Luxury Property Investments

While luxury property investments offer numerous benefits, they are not without risks. Understanding these risks and how to manage them is crucial for successful investing.

- Market Volatility: Like all real estate, luxury markets can experience fluctuations. Economic downturns or shifts in buyer preferences can affect property values. To mitigate this risk, conducting thorough market research and investing in locations with strong fundamentals and growth potential is essential.

- High Entry Costs: The initial investment in luxury properties is significantly higher than in average homes. Investors must be prepared for substantial down payments and maintenance costs. It’s wise to have a robust financial plan and consider properties that offer long-term value rather than focusing solely on immediate returns.

- Regulatory Risks: Real estate is subject to various regulations impacting investment viability. Changes in zoning laws, taxation, or foreign ownership rules can affect property values. Staying informed about local regulations and market conditions is crucial for navigating these risks.

- Liquidity Challenges: Luxury properties can be less liquid than other investments. Selling a luxury property may take longer than anticipated during times of economic uncertainty. Investors should consider their exit strategy and be prepared for potential holding periods.

Your Pathway to Investing in Luxury Properties

There are several pathways to explore for those intrigued by luxury real estate investments. Engaging with experienced professionals specializing in luxury investments can significantly enhance your understanding of the market. These experts can offer valuable insights into identifying lucrative opportunities and navigating pitfalls.

For example, consider partnering with a firm that employs innovative strategies to acquire undervalued luxury properties. Investors can realize substantial profit margins by targeting distressed assets and renovating them to meet luxury standards. Establishing solid relationships within the property industry—such as with real estate agents, lawyers, and accountants—can add significant value to your investment strategy.

For a presentation or report on Luxury Property Investments: A Proven Strategy for Wealth Creation in 2024, a table or graph can help illustrate key data points effectively. Here are a few possible options:

1. Table of Key Indicators in Luxury Property Investments

This table could present comparative data on indicators for 2024, showcasing the stability and returns of luxury property investments.

| Investment Metric | 2024 (Projected) | 2023 | YoY Change (%) |

|---|---|---|---|

| Average Property Value Increase | 10.5% | 8.3% | +2.2% |

| Rental Yield for Luxury Properties | 7.2% | 6.5% | +0.7% |

| Market Demand (Properties Sold) | 1.2 million units | 1.1 million units | +9.1% |

| Investor Confidence Index | 78% | 72% | +6% |

| Average Return on Investment (ROI) | 15.3% | 13.8% | +1.5% |

2. Graph: Growth in Luxury Property Value (2019-2024)

A line graph would visually demonstrate the increase in luxury property values over time.

import matplotlib.pyplot as plt

# Sample data

years = [2019, 2020, 2021, 2022, 2023, 2024]

property_values = [1.5, 1.65, 1.8, 1.95, 2.1, 2.3] # In millions USD

plt.plot(years, property_values, marker='o')

plt.title("Growth in Luxury Property Value (2019-2024)")

plt.xlabel("Year")

plt.ylabel("Property Value (Million USD)")

plt.show()

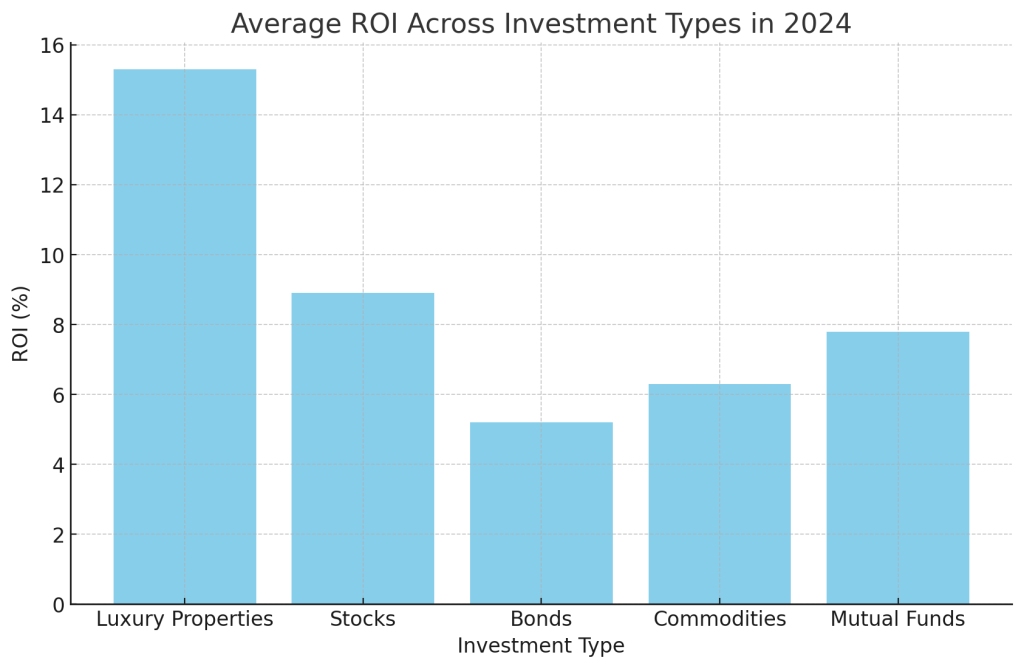

3. Bar Chart: Comparison of Average ROI Across Investment Types in 2024

A bar chart could compare the ROI across various types of investments for 2024.

import matplotlib.pyplot as plt

# Investment types and ROI percentages

investments = ['Luxury Properties', 'Stocks', 'Bonds', 'Commodities', 'Mutual Funds']

roi = [15.3, 8.9, 5.2, 6.3, 7.8]

plt.bar(investments, roi)

plt.title("Average ROI Across Investment Types in 2024")

plt.xlabel("Investment Type")

plt.ylabel("ROI (%)")

plt.show()Conclusion

As we approach 2024 and beyond, luxury property investments emerge as a gold standard for securing and growing wealth. The combination of market resilience, appreciation potential, and lifestyle benefits make them an attractive option for investors. While it’s crucial to understand and manage the inherent risks, the strategic advantages and positive market trends suggest that now is an opportune time to consider luxury real estate as part of your investment portfolio.

By staying informed and making strategic decisions based on current market trends, you can position yourself to reap the rewards of property investments. Whether you are a seasoned investor or exploring luxury real estate for the first time, these investments offer a pathway to secure your wealth and elevate your lifestyle in the years to come.

[ruby_related heading=”More Read” total=5 layout=1 offset=5]

FAQs

1. What is considered a luxury property?

Luxury properties typically refer to high-end real estate that offers premium features, amenities, and locations. They are often characterized by exclusivity and superior quality.

2. Are luxury property investments an excellent way to secure wealth?

Yes, investments can provide long-term appreciation, rental income potential, and diversification benefits, making them an attractive option for wealth preservation.

3. What are the risks associated with property investments?

Risks include market volatility, high entry costs, regulatory changes, and liquidity challenges. Conducting thorough research and having a sound investment strategy can help mitigate these risks.

4. How do I choose the right luxury property to invest in?

Consider factors such as location, market trends, property condition, and potential for appreciation. Engaging with a knowledgeable real estate professional can also provide valuable insights.

5. Can luxury properties generate rental income?

Many luxury properties can be leased for substantial rental income, especially in high-demand markets. Short-term rental options can also increase cash flow potential.

In conclusion, luxury real estate investments represent an innovative and strategic approach to securing your wealth in 2024. With the proper knowledge and planning, you can successfully navigate the luxury real estate market, ensuring financial growth and an enhanced lifestyle.